Family Business Succession Planning: Balancing Emotions and Strategy

Posted: May 20, 2025

Succession planning in a family business is more than a financial or operational decision — it’s a deeply personal journey. Emotions, legacy, and relationships are tightly woven into the fabric of the business, making the transition process uniquely complex. Successfully navigating this shift requires a thoughtful balance between honouring family values and applying sound strategic planning to ensure long-term success.

Unlike other organizations, family businesses carry emotional weight. Founders often see the business as an extension of themselves, and family members may have unspoken expectations about their roles in the future. These dynamics can complicate even the most well-intentioned plans.

Some common emotional challenges include:

Acknowledging these emotional layers is the first step toward a successful transition. It’s not just about passing the baton—it’s about managing change in a way that honours the past while preparing for the future.

While emotions are real and valid, they must be balanced with clear, strategic thinking. A well-structured succession plan protects the business, supports the family, and ensures continuity. Here are the key components:

Succession planning should begin years before an actual transition. This allows time to:

Early planning also reduces the risk of reactive decisions during times of crisis or health issues.

Clarity is critical. Clearly outline:

This helps prevent power struggles and ensures everyone understands their role in the new structure.

Choosing a successor should be based on merit, not just birth order or tradition. Consider:

If no family member is ready or willing, consider external leadership while maintaining family ownership.

Establishing formal governance structures — such as a board of directors or advisory board — can help separate emotional decisions from strategic ones. Family councils or charters can also provide a forum for discussing family-related matters without interfering with business operations.

Whether the transition involves gifting shares, selling the business, or a hybrid approach, financial planning is essential. Key considerations include:

Working with financial advisors and legal professionals ensures the transition is both equitable and tax-efficient.

Legacy is a powerful part of any family business. It reflects the values, culture, and history that have shaped the company. But legacy should not become a barrier to progress.

Here’s how to honour the past while preparing for the future:

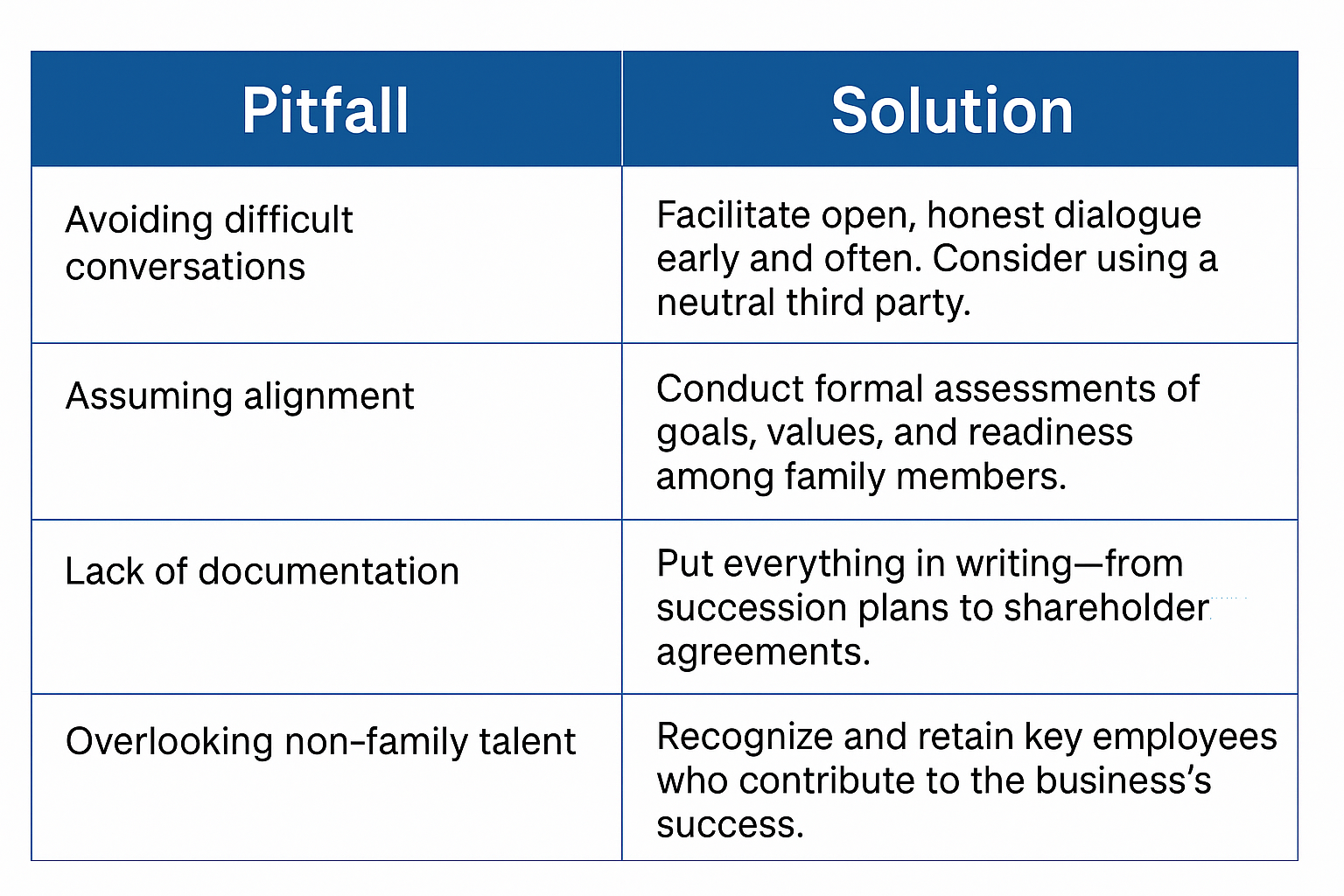

Even with the best intentions, family business transitions can go awry. Here are some common pitfalls — and how to avoid them:

Bringing in external advisors can make a significant difference. They offer objectivity, experience, and a structured approach to what can be an emotionally charged process. Advisors can help with:

At Rizolve Partners, we specialize in helping family-owned businesses navigate these complex transitions with clarity and confidence. Our approach blends strategic insight with empathy, ensuring that both emotional and business needs are respected and addressed.

Transitioning a family business is one of the most significant decisions an owner will make. It’s not just about who takes over—it’s about ensuring the business thrives for generations to come. By balancing emotional considerations with strategic planning, families can create a transition plan that protects their legacy and positions the business for continued success.

Whether you’re just beginning to think about succession or are actively planning a transition, remember: the best outcomes come from conversations that are both heartfelt and thoughtfully strategic.

If you’re beginning to think about succession or facing a complex transition, Rizolve Partners is here to help. Our experienced advisors specialize in guiding family-owned businesses through every stage of the journey—from planning to execution. Contact us today to start a conversation about your future.