In the rapidly evolving digital age, AI tools are a powerful streamliner for businesses of all sizes. While large corporations have already begun to harness its potential, small to medium-sized companies can also benefit significantly from AI. Understanding how AI can be integrated into various aspects of your business is crucial for staying competitive and innovative.

Let’s delve into five key areas every business owner should understand and consider to position their company for success.

1. AI Tools That Streamline Operations

Automation of Routine Tasks

One of the most significant advantages of AI is its ability to automate repetitive tasks. For SMEs, this means freeing up valuable time and resources that can be redirected towards more strategic activities.

Administrative Tasks: AI can handle tasks such as scheduling, data entry, and email management, reducing the workload on employees.

Customer Service: Chatbots and virtual assistants can manage customer inquiries 24/7, providing instant responses and improving customer satisfaction.

According to a survey conducted by Censuswide and Visier in the UK, USA, Canada, and Germany, “employees have reported an average of 1.75 hours saved each day, resulting in over a full day’s worth of work each week saved through the use of generative AI applications.”

Supply Chain Optimization

AI can also revolutionize supply chain management by predicting demand, managing inventory, and optimizing logistics. For SMEs, this means reduced costs and improved efficiency.

Predictive Analytics: AI algorithms can analyze historical data to forecast demand, helping businesses maintain optimal inventory levels.

Logistics: AI can optimize delivery routes and schedules, ensuring timely deliveries and reducing transportation costs.

A study conducted by McKinsey & Company revealed that “AI can reduce supply chain forecasting errors by 50% and reduce lost sales by 65% with better product availability.“.

2. AI Tools That Enhance Customer Experience

Personalized Marketing

AI enables SMEs to deliver highly personalized marketing campaigns by analyzing customer data and behaviour. This level of personalization can significantly enhance customer engagement and loyalty.

Customer Segmentation: AI can segment customers based on their preferences, purchasing history, and behaviour, allowing for targeted marketing strategies.

Content Recommendations: Personalized recommendations based on previous interactions can drive sales and improve customer satisfaction.

McKinsey & Company found that “71% of consumers expect companies to deliver personalized interactions. And 76% get frustrated when this doesn’t happen.”.

Improved Customer Insights

Understanding your customers better is crucial for any business. AI can provide deep insights into customer preferences, trends, and feedback.

Sentiment Analysis: AI can analyze customer reviews and social media comments to gauge customer sentiment, helping businesses improve their products and services.

Behavioural Analytics: By tracking customer interactions, AI can predict future behaviours and preferences, enabling proactive engagement.

In light of these advancements in sentiment analysis and behavioural analytics, “82% of executives are reevaluating their consumer experience strategies.”.

3. AI Tools For Driving Innovation

Product Development

AI can accelerate product development by analyzing market trends, customer feedback, and competitive data. For SMEs, this means staying ahead of the curve and continuously innovating.

Idea Generation: AI can identify gaps in the market and suggest new product ideas based on data analysis.

Prototyping: AI-powered tools can streamline the prototyping process, reducing time-to-market for new products.

The Penn State Institute for the Study of Business Markets found that leading early adopter firms are experiencing 50% shortened development time for new product development.

Competitive Analysis

AI can provide a comprehensive analysis of competitors, helping SMEs to refine their strategies and identify new opportunities.

Market Trends: AI can track and analyze market trends, offering insights into emerging opportunities and potential threats.

Competitor Strategies: By analyzing competitors’ activities, AI can help businesses identify their strengths and weaknesses.

According to a recent article from Forbes, leveraging AI competitor analysis rapidly increases the rate at which businesses can analyze competitor product portfolios, gather market data (pricing, reviews, product features), track competitor activities, and identify potential new market entry points.

4. AI Tools For Enhancing Decision-Making

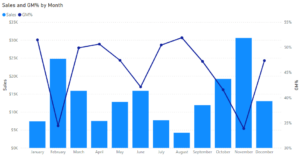

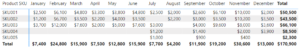

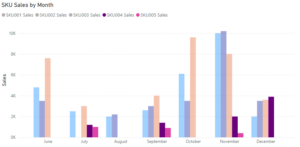

Data-Driven Decisions

AI empowers businesses to make data-driven decisions by providing real-time analytics and insights. This capability is particularly beneficial for SMEs, where strategic decisions can significantly impact growth.

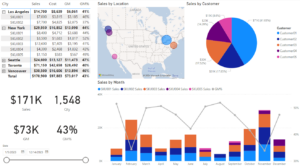

Performance Metrics: AI can track and analyze key performance indicators (KPIs) in real time, providing actionable insights.

Scenario Planning: AI can simulate various business scenarios, helping leaders make informed decisions under uncertainty.

Data gathered by thesocialsheperd.com found that 41% of business leaders saw improved decision-making, and 36% were able to generate data-driven business models for the first time.

Risk Management

AI can also enhance risk management by predicting potential risks and suggesting mitigation strategies. For SMEs, this means safeguarding the business against unforeseen challenges.

Financial Risks: AI can analyze financial data to predict cash flow issues and suggest solutions.

Operational Risks: By monitoring operations, AI can identify potential bottlenecks and inefficiencies before they escalate.

A study conducted by FinTech Global found that “enhanced risk identification” ranked as the second most value-generating application of AI technology. “AI improves monitoring and reporting for risk and compliance, enabling more timely and precise identification of risks.”.

5. AI Tools That Create Content

Automated Content Generation

Generative AI, such as language models and creative algorithms, can assist SMEs in creating high-quality content efficiently. This is particularly useful for marketing, social media, and customer engagement.

Blog Posts and Articles: AI tools can generate draft articles or blog posts based on keywords and topics, saving time for content creators.

Social Media Content: AI can create engaging social media posts tailored to your audience’s preferences and trends.

In 2023, InsiderIntelligence.com conducted a survey of companies that use AI for content creation. Over half of the group surveyed stated AI content creation led to increased performance, increased creative variety, cost efficiencies, and faster creative cycles.

Creative Design and Multimedia

AI can also generate visual content, such as graphics, videos, and infographics, helping SMEs maintain a consistent and appealing brand presence.

Graphic Design: AI-powered design tools can create logos, banners, and promotional materials quickly.

Video Editing: AI can automate video editing processes, producing professional-quality videos with minimal effort.

As with most current AI applications, some human oversight and refinement is required. In order to create engaging and creative graphics, humans need to guide AI tools by providing clear objectives, artistic direction, and feedback. This collaboration ensures that the final products align with the brand’s aesthetic and effectively communicate the intended message, combining the efficiency of AI with the nuanced creativity of human designers.

Harnessing AI for Business Growth

AI is poised to transform the way small to medium-sized companies operate. From automating routine tasks and optimizing supply chains to enhancing customer experiences, driving innovation, and generating content, AI offers numerous benefits that can help SMEs stay competitive and grow. As AI technology continues to evolve, its integration into various business processes will become increasingly essential. Embracing AI now can position your business for success in the future.

By understanding and leveraging the power of AI, SMEs can unlock new levels of efficiency, insight, and innovation, ensuring they not only survive but thrive in the digital age.

Maximize Your Business Value with Rizolve Partners

Integrating AI tools is just one step towards enhancing your business’s value. At Rizolve Partners, we specialize in comprehensive business valuations and strategic action plans that drive growth and increase value. Our tailored approach ensures that your business not only adapts to technological advancements but also excels in operational efficiency and market competitiveness.

Ready to unlock your business’s full potential with AI and beyond? Contact Rizolve Partners today to start building your business value, improving organizational effectiveness, and accelerating value growth.